In The Minotaur’s Handmaidens Part A, my last post, I looked at two important contributors to the Global Minotaur: to America’s astonishing pre-2008 capacity to attract financing from the capital surpluses of the rest of the world sufficient for the purposes of funding its expanding twin deficits. These two contributors were, on the one hand, the mergers and acquisitions drive and, on the other, what the financial sector called hedging and leverage. Today I look at another two important contributors (Minotaur Handmaidens, as I like to call them): (a) The Wal-Mart business model in US services and industry and (b) Wall Street‘s newwfangled (in the late 1970s) capacity to ‘print’ its very own toxic private money.

An ideology of cheapness for the Age of Excess: The Wal-Mart effect

Wal-Mart is one of the largest conglomerates in the world. With annual earnings in excess of $335 billion, it is second only to oil giant Exxon-Mobile. The reason it is singled out here is because Wal-Mart symbolises a brand new phase of capitalist accumulation, one that is close to the Global Minotaur‘s logic.

Unlike the first conglomerates that evolved on the back of impressive inventions and technological innovations in the 1900s, Wal-Mart and its ilk built empires based on next to no technological innovation, except a long string of ‘innovations’ involving ingenious methods of squeezing their suppliers’ prices and generally hacking into the rewards of the labourers involved at all stages of the production and distribution of its wares. Wal-Mart’s significance revolves on a simple axis: In the era of the Global Minotaur it traded on the American working class’ frustration from having lost the American Dream of ever increasing living standards and its related need for lower prices.

Unlike other corporations that focused on building a particular brand (e.g. Coca Cola or Marlboro), or companies that created a wholly new sector by means of some invention (e.g. Edison with the light bulb, Microsoft with its Windows software, Sony with the Walkman, or Apple with the iPod/iPhone/iTunes package), Wal-Mart did something no one had ever thought of before: It packaged a new Ideology of Cheapness into a brand that was meant to appeal to the financially stressed American working and lower-middle classes.

Take, for example, Vlasic pickles, a well known everyday brand. Wal-Mart’s ‘innovation’ was to sell these pickles in one gallon (3.9 litre) jars for $2.97. Was this a shrewd retailer’s response to market demand? No it was not. Who would want to buy almost four litres of pickles? Few family fridges had the necessary room for such an item. So, what was the selling point? It was the idea of a huge quantity at an ultra low price. Wal-Mart’s buyers, in this sense, were not buying pickles as such. They were buying into the symbolic value of cheapness; into the notion of having appropriated so many pickles for such little money. Indeed, it made them feel like they were Wal-Mart’s accomplices; that, in association with an icon of American corporate might, they had forced producers to make available so much for so little!

The gigantic jar of cheap pickles in the fridge thus ended up denoting a small victory at a time of wholesale defeat. Whose defeat? The average American worker’s whose real wages had never recovered since 1973 (recall the last chapter) and whose working conditions deteriorated as employers everywhere copied the Wal-Mart model faithfully. Do you know, dear reader, why it is wrong to say that Wal-Mart mistreats its employees? Because it does not have any! At least not according to Wal-Mart which describes its employees as ‘associates’.

What this means is that the company does not consider itself to be bound to treat its workforce as living, human, waged labour. Instead it employs Orwellian language by which to explain its blanket ban on any trades union activity on its premises. The result is that Wal-Mart’s ‘associates’ work for less than $10 per hour,[1] are habitually forced to work overtime with no additional pay, and are often locked up inside the warehouses while working overnight. These practices have resulted in lawsuits in 31 states.[2]

The situation in the workshops and fields of the Third World, where goods are grown or produced on behalf of Wal-Mart, is, as one can imagine, bordering on the criminal. Defenders of the type of globalisation imposed upon the rest of the world by Wal-Mart and by the Global Minotaur will argue that growth has been strong for two decades internationally, a trend that seems to continue. Surely, this is good for the poor. But what this misses is the distributive effect of Wal-Mart-type practices on the poor.

The United Nations report on global poverty tells us that in and around 1980, for every $100 of world growth, the poorest 20% received $2.20. Twenty one years later, in 2001, in the poorer countries both the output and employment related to multinational companies like Wal-Mart had increased substantially. This is the case for the defence: “We increased their work, boosted their employment,” they contend with some justification. Yet, at the same time, we now know that, during the same period, an additional $100 of world growth translated in a measly extra 60 cents for the poorest 20%. Furthermore, when one takes into account that disproportional rise in prices for basic commodities, as well as the diminution in public services following the IMF’s structural adjustment programs (following the Third World Debt Crisis of the 1980s), there appears to be very little cause for celebration on the behalf of our poverty-challenged fellow humans.

In Robert Greenwald’s 2005 shocking documentary Wal-Mart: The High Cost of Low Price a woman working in a Chinese toy factory asks “Do you know why the toys you buy are so cheap?” and then proceeds breathlessly to answer her own question: “It’s because we work all day, every day and every night.”

Wal-Mart: A corporation after the Minotaur‘s heart The immediate effect of the Wal-Mart ‘business model’ (that was adopted by many other companies, e.g. Starbucks) was, quite obviously, anti-inflationary. This was essential for the Global Minotaur‘s continuing rude health since the flow of foreign capital to the United States was, partly, predicated upon US inflation trailing that of other, competing, capitalist centres. In Wal-Mart’s defence one may argue that it was simply responding to the facts. As the Minotaur was gathering strength, American workers felt their diminishing purchasing power in their bones. Wal-Mart simply responded to this reality by providing them with basic products at prices reflecting their diminishing capacity to pay. Was this not a decent helping hand which American families in danger of slipping into poverty needed?

The facts beg to differ: Wal-Mart’s overall effect has been quite the opposite. Wherever Wal-Mart expanded, poverty rates rose. Consider, for instance, the 1990s: a period of rapid growth in the United States, courtesy of the Global Minotaur and its astonishing capacity to attract other people’s capital into the country. So, poverty rates began to decline (only to rise again after 2001, under George W. Bush’s administration). During that decade of declining poverty rates, something extraordinary happened: Poverty rates not only proved more stubborn in towns where Wal-Mart set up shop but, indeed, in many such regions poverty rates rose against the national trend!

Summing up, Wal-Mart represents more than corporate oligopoly capitalism. It represents a new guise of corporation which evolved in response to the circumstances brought on by the Global Minotaur. The Wal-Mart extractive business model reified cheapness and profited from amplifying the feedback between falling prices and falling purchasing power on the part of the American working class. It imported the Third World into American towns and regions and exported jobs to the Third World (through outsourcing), causing the depletion of both the ‘human stock’ and the natural environment everywhere it went. Wherever we look, even in the most technologically advanced US corporations (e.g. Apple), we cannot fail to recognise the influence of the Wal-Mart model. The Global Minotaur and Wal-Mart rose in prominence at about the same time. It was not a coincidence.

Tainted houses, toxic cash: Wall Street generates its own private money

With wages stagnant, against a background of inconspicuous profiteering and a marketing blitz depicting incessantly the new gadgets and props of a successful life, the banks had an idea: Why not use their expanding capital inflows (from abroad but also from the accumulation of domestic profits) in order to extend credit to middle and working class households both in the form of mortgages and of personal loans and credit cards?

Once upon a time, the relatively low paid would risk accepting credit facilities only on the expectation of rising future wages. In the Global Minotaur era, however, there could be no credit expansion on that basis. While the average American worker was bombarded with heroic reports of America’s high growth rates, any hopes these figures might have raised were forever crushed by the ruthlessness of her personal, local reality. Her sole line of communication with that ‘other’ world, where incomes rose and living standards improved, was home ownership. At a time when house price rises seemed permanent, bricks and mortars became the only realistic hope of riding the wealth escalator.

Thus, millions of Americans borrowed to buy a home and, almost instantly, borrowed against that home to buy other (mostly imported) goodies. The result was that private debt levels were rising even faster than the corporations’ profitability throughout the United States and parts of the world (mostly with a strong Anglo-Celtic ethnic imprint) that had managed to attach themselves onto the Minotaur‘s coattails. In America, the rises in unsecured debt levels were stupendous. In the 1970s personal and credit card debts rose, compared to 1960s, by 238%. In the 1980s, the rise relative to the 1970s jumped to 318%. In the 1990s, largely due to the 1991 recession, debt levels rose again (relative to the 1980s) by ‘only’ 180%. And in the eight years before the 2008 Crash, we observe a rise (relative to the already indebted 1990s) of 163%.

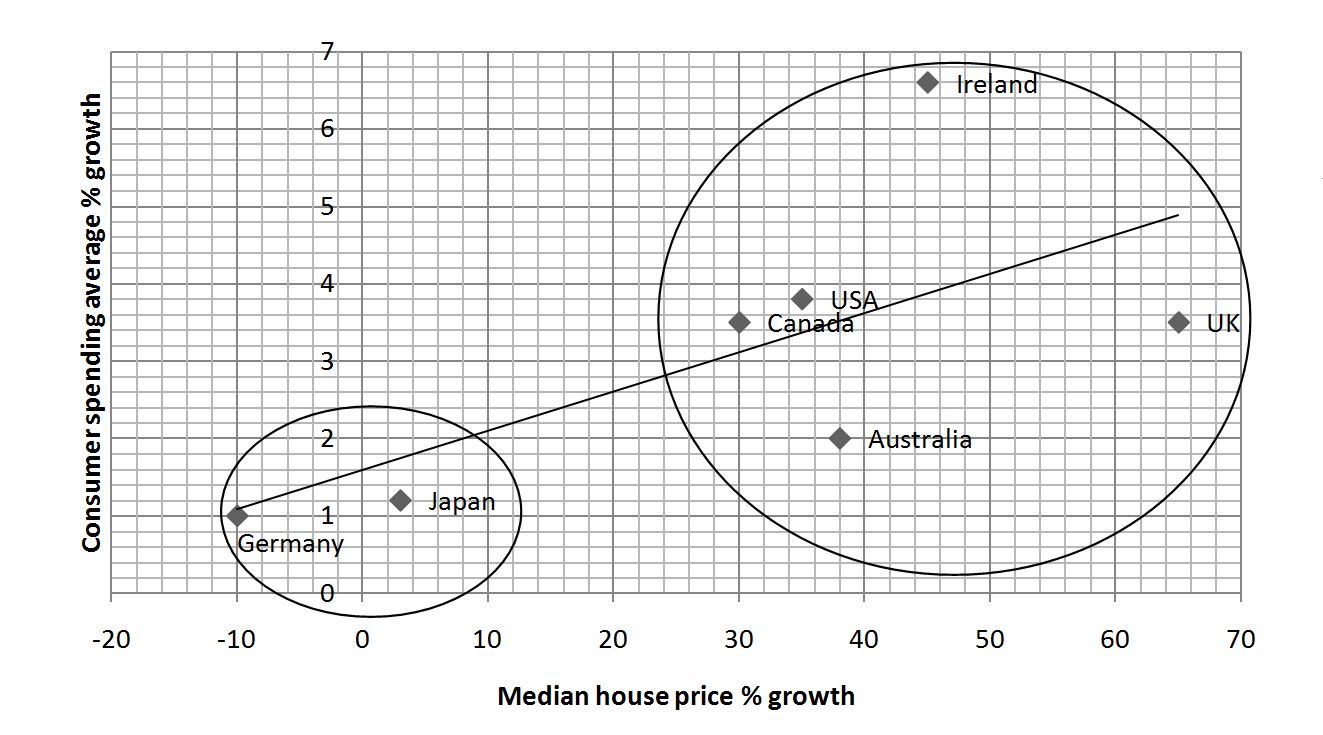

Perhaps the most widely felt effect of the Global Minotaur‘s ascendancy was its impact on house prices. Anglo-celtic countries, with the United States leading the way, saw the largest rises in house price inflation. The combination of the foreign capital inflows, domestic US profits and the increasing availability of bank loans pushed house prices up at breathtaking speed. Between 2002 and 2007 the median house price rose by around 65% in Britain, 44% in Ireland, and by between 30% and 40% in the USA, Canada and Australia.

There is an interesting antinomy in the way popular culture, and the financial commentariat, treat increasing house prices. Whereas inflation is thought of as an enemy of civilisation and a scourge, house price rises are almost universally applauded. Homeowners feel good when estate agents tell them that their house is now worth a lot more, even though they know very well that this is akin to monopoly money; that, unless they are prepared to sell and leave the country (or move into a much smaller house or in a ‘worse’ area), they will never ‘realise’ that ‘value’. Nevertheless, the rise in the asset’s nominal value never fails to make house owners feel more relaxed about borrowing in order to finance consumption. This is precisely what underpinned the stunning growth rate in places like Britain, Australia and Ireland.

The following graph exposes nicely the correlation between the housing price inflation rate and consumption growth. The Anglo-Celtic countries in which house prices boomed were also the ones in which consumption rose fast. Meanwhile, in the two ex-US protégés, Germany and Japan (the two countries that were financing the Anglo-Celtic deficits through their industrial production, which the Anglo-Celtic countries were, in turn, absorbing) house prices not only did not increase in value but, in the case of Germany, they actually dropped.

Correlation between median house price inflation and the growth in consumer spending, 2002-2007

Correlation between median house price inflation and the growth in consumer spending, 2002-2007

The graphic correlation (see above) between the house bubble and consumption-driven growth was reinforced by a famous instrument: Securatised Derivatives or Collateralised Debt Obligations, CDOs for short. How did they link housing debt with consumption-driven growth? To answer this question, it is helpful to begin with a self evident truth: The banks’ main principle has traditionally been never to lend to anyone unless she did not need the money. But this principle clashed with the urge to lend to those poor enough to be willing to pay higher interest rates than those who had other alternatives (i.e. the rich). Enter the CDOs.

Their function was to allow banks to lend even to paupers, and at high interest rates, without fear that they will default. Not because some magical formula had been devised to shield the poor from poverty, the job-insecure from unemployment and the bankrupt from bankruptcy, but because the CDOs allowed the banks to originate and spread; to lend and then immediately sell the loan on. This is roughly how they worked:

The trick was to combine different kinds of loans: Safe loans (e.g. taken out by some rich lawyer to buy a summer house), loans bearing some risk (e.g. money borrowed by a firm with a decent track record) and low quality, or sub-prime, loans (e.g. a mortgage taken out by a family that would almost certainly not manage to meet its repayments after the initial low interest period expired) were all summed up and then divided into small packages, the CDOs, each containing slices (or tranches) of these different loans, with each slice paying different interest rates and coming with different default risks.

The mathematics that estimated how much money the owner of this CDO was due on the CDO’s expiry were so complex that even its creator could not decipher them. However, the mere hint that brilliant mathematical minds had designed their structure, and the solid fact that Wall Street’s respected, and feared, credit ratings agencies had given them their seal of approval (which came in the form of AAA ratings), was enough for banks, individual investors and hedge funds to buy and sell them internationally as if they were high grade bonds or even cash.

This, as the reader will have gathered by now, is the sad tale of sub-prime mortgages. The story of how Wall Street, not content to process and build upon the tsunami of foreign capital and domestic corporate profits that the Minotaur was pushing its way, tried to profit also from poor people by selling them mortgages which they could never really afford. By 2005, more that 22% of US mortgages were of this sub-prime variety. By 2007, the percentage had risen further to 26%. All of them were inserted into CDOs before the ink had dried on the dotted line.

In raw numbers, between 2005 and 2007 alone, US investment banks issued about $1.1 trillion of CDOs. In terms of value, in 2008 the mortgage-backed bonds came to almost $7 trillion, of which at least $1.3 trillion were based mainly on subprime mortgages. The significance of that number is that it is larger even than the total size of the, arguably gigantic, US debt. But to give an accurate picture of the disaster in the making, it is important to project these vast numbers in relation to one another as well as to the level of global income: Back in 2003 for every $1 of world income, $1.80 worth of derivatives circulated. Four years later, in 2007, that ratio had risen by 640%: Every $1 of world income corresponded to almost $12 worth of derivatives. The world of finance had evidently grown too large to be contained on planet Earth!

It was an heroic time during which money seemed to be growing on trees. Traditional companies that actually produced ‘things’ were derided as old-hat. What steel producer, car manufacturer or even electronics company could ever compete with Wall Street’s amazing returns? All sorts of companies wanted to join in! Staid corporations like General Motors entered, for this reason, the derivatives racket. At first they allowed the company’s finance arm, whose aim was to arrange loans on behalf of customers that could not afford the full price of the firm’s product (e.g. higher purchase for cars), to stick a toe in the derivatives pond. They liked the feeling and the nice greenbacks streaming in. Soon, that finance arm ended up becoming the company’s most lucrative section. So, the firm ended up relying more and more for its profitability on its financial services and less and less on its actual, physical product.

Before long, the world economy became addicted to these financial instruments, of which the CDOs were one example. Soon they began to function not only as ‘stores of value’ but also as ‘means of exchange’: they had turned into a very private form of money. Once the Clinton administration released Wall Street from all regulatory restraints, by a decision that is credited to US Treasury Secretary Larry Summers, the global economy was flooded with this private money. Its infinite supply kept interest rates down all over the world, fuelling asset bubbles (from Miami and Nevada to Ireland and Spain) and encouraging states in chronic deficits (e.g. Greece) to plug their budgets with cheap, over-the-counter, loans.

Notice the irony: In a world ideologically dominated by monetary conservatism, and ringing with long sermons about the perils of printing money, the effective money supply had been turned over to privateers bent on flooding the markets with money of their own making. How did this differ, really, to handing the Fed’s printing presses over to the mafia? Not much, is the honest answer.

According to standard conservative economic theory, too much money flooding into the economy, especially during an economic upturn, is a recipe for the catastrophic loss of the market’s capacity to send meaningful signals to producers and consumers on what to produce and what to economise. And yet none of the high priests of fiscal and monetary conservatism batted an eyelid while zillions worth of toxic private monies, over whose quantity and worth no one had the slightest control, were inundating the globe. For they, just like corporate capitalism in America and elsewhere, had themselves become addicted to the newfangled currency’s power.

When the plug was pulled in 2008, and all the private money disappeared from the face of the earth, global capitalism was left with what looked like a massive liquidity crisis. It was as if the lake had evaporated and the fish, large and small, were quivering in the mud. The problem was, however, deeper and larger: The loss of the private money brought the Global Minotaur to its knees. With it came crashing down the only mechanism the world economy had for recycling its surpluses. Thus, a Crisis from which no liquidity-pumping by the Fed and the other Central Bankers can help us escape.

[1] Which, although higher than the minimum wage in the United States, means that its workers live permanently under the poverty, qualifying for US government food stamps.

[2] Moreover, in a curious case of misogyny, Wal-Mart seems unwilling to promote its female workers. Apparently, the largest private lawsuit in US history involved Wal-Mart’s underpayment of and failure to promote more than 1.5 million women workers.