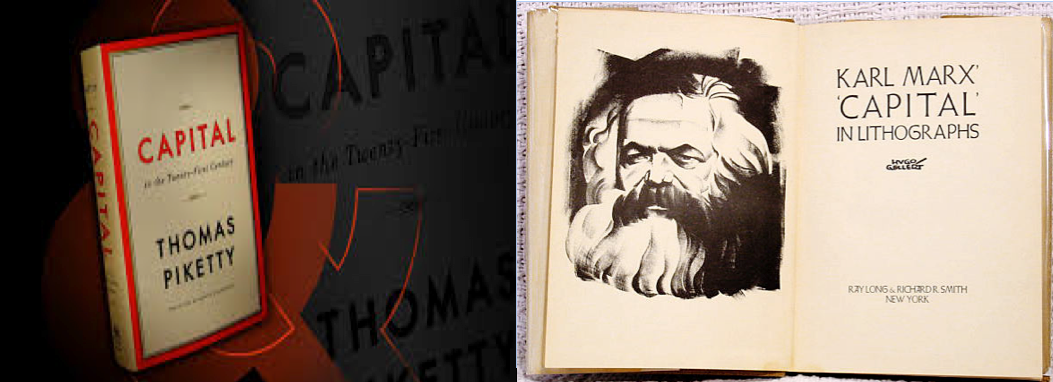

On 6th December, I was kindly invited by the editorial board of Science & Society (the oldest continuously published journal of Marxist scholarship worldwide) to deliver a keynote to its Editorial Board’s Annual Meeting. My talk was based on a recent critical review of Piketty’s Capital in the 21st Century which can be read here. To listen to my talk, click...

Thomas Piketty’s Capital in the 21st Century from a Marxist Perspective – audio

14/12/2014 by YanisV

Related Posts

Box0_TOP_ENG English French Le Monde Op-ed Politics and Economics Technofeudalism Technofeudalism: What killed capitalism

Musk, Trump and the Broligarchs’ novel hyper-weapon – Le Monde 4-1-2025, full original English version