Mrs Merkel went to Brussels intent on striking two birds with one stone, pick up her bag immediately and return to Berlin with no further ado. The stone was the fraudulent re-packaging of existing structural and EIB funds (with the addition of a paltry 10 billion euros) into a grandiose-sounding ‘Growth Pact’. The two birds were, respectively, the SPD opposition back home (which had set as its condition for supporting the ratification of the ESM some ‘movement’ on growth) and Mr Hollande (who also needed some semblance of a Growth Pact to sell it to his voters as sugar coat with which to swallow the bitter pill of the Fiscal Pact).

The early part of the summit was expended discussing this inconsequential ‘Growth Pact’. When it was seemingly in the bag, Mr Rumpoy and Mrs Merkel tried to make a clean getaway, hoping that the summit was over. It was at that point that Mr Monti called the Chancellor’s bluff. In effect, he threatened the summit with permanent delay until two agreements were reached: One was the direct recapitalisation and supervision of banks (from the EFSF and the ECB); precisely as outlined in our Modest Proposal two years ago. The other was that Italy (and one presumes other countries) gains access to direct EFSF funding (i.e. that the EFSF is allowed to purchase Italian bonds in the primary market). Naturally, Mrs Merkel resisted. But, as if to prove once again that her recalcitrance was always paper thin, the moment Spain and France sided with Italy, she buckled. The result was the very first sensible EU Council agreement since the Crisis erupted.

Having said that, any celebration is extremely premature. First, Mrs Merkel has not spoken her last word. As before, this new role for the EFSF (and the ECB, in terms of its fresh bank supervisory role) may become undone in Berlin’s Federal Parliament, at the hands of the German Constitutional Court, or in the shadowy corridors of power in Frankfurt, Berlin, or Brussels. Secondly, even if this agreement is confirmed in the practice, rather than in the breach, it is only one small step. It will come to naught unless the toxicity of the EFSF is dealt with (see Policy 2 of the Modest Proposal, as an example of how this could be accomplished) and some genuine Growth Spurt is implemented (a New Deal for Europe, as we like to call it in Policy 3 of the Modest Proposal).

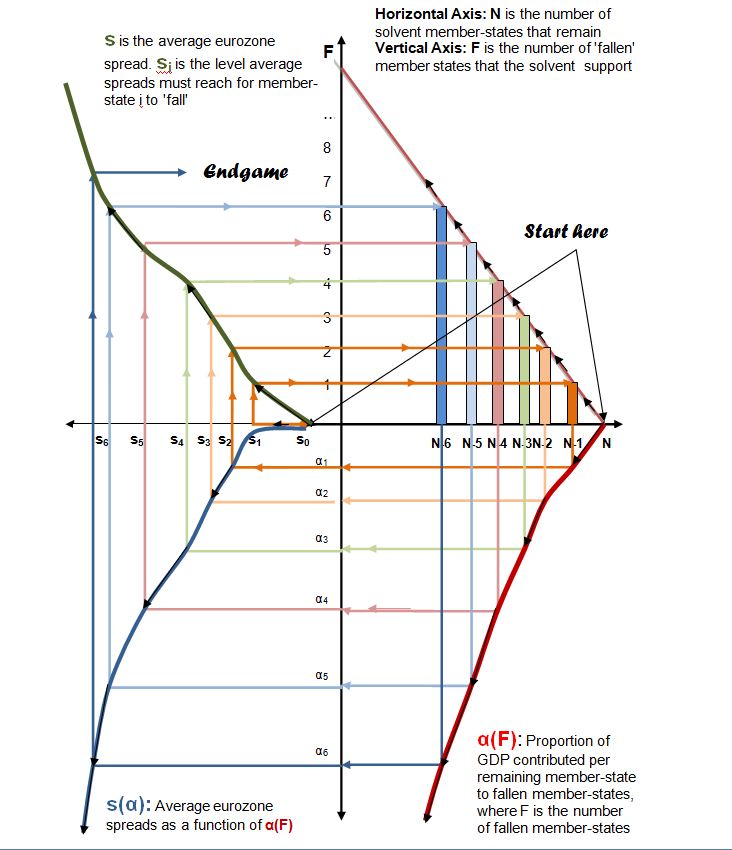

In a post last August, I explained why the EFSF is toxic and the reason for which it either will not have enough money for the job assigned to it (as per now) or, if allowed to raise enough money (under its existing CDO-like bond issues), the impact of its new found ‘wealth’ will put the Eurozone in the path of another vicious domino effect. For aesthetic purposes I reproduce the diagram I used to narrate my analysis back then. For the full analysis, click Why Italy? Why Spain? And why the EFSF’s size does not matter

In conclusion, the Eurozone is most certainly not out of the woods. Yesterday’s summit took an important decision that will buy Europe another few months. The gist of that decision was to rationalise the use of the EFSF’s funds. Alas, the EFSF’s way of raising funds is still irrational and conducive to a medium term reignition of the domino effect which, this time, will push France over the cliff. Or, to put it differently, and in terms of our Modest Proposal, Europe yesterday decided to adopt the essence of Policy 1. It has done nothing regarding Policies 2 and 3 (without which Policy 1 isbunk). While it may be satisfying to brag “One Down, Two to Go”, I very much fear that, truth be told, the accurate verdict is: One (policy) down, the other two are not even on the table and, soon, the one that is ‘down’ will probably dissolve in a cloud of parliamentarian, constitutional and bureaucratic debris, caused my Mrs Merkel’s tactical defeat.

Epigrammatically, for the first time ever a EU summit reached a sensible decision which, nonetheless, is still unlikely to provide the glue that keeps the euro together. Not unless this decision is acted upon speedily and foreshadows the other two decisions without which it is an empty letter.