Recently I was at a coffee shop, and to test a metaphysical hunch I asked a few of my fellow caffeinated confreres this question: “What is money?” They all gave answers along the following lines. Money is an arbitrary symbol of exchange value that we just make up in order to facilitate trade and investment. Money itself isn’t any thing but it is a collectively believed in fiction which operates as a very useful means of exchange.

Recently I was at a coffee shop, and to test a metaphysical hunch I asked a few of my fellow caffeinated confreres this question: “What is money?” They all gave answers along the following lines. Money is an arbitrary symbol of exchange value that we just make up in order to facilitate trade and investment. Money itself isn’t any thing but it is a collectively believed in fiction which operates as a very useful means of exchange.

This sort of answer confirmed my hunch nicely: us Modern people have no idea how (or even if) money is connected to real wealth. It was Medieval economics that opened my eyes to this fascinating and possibly very important insight.

If you were to ask a medieval person the question “What is money?” they would not tell you that it is simply a made up means of marketplace exchange. They would not say anything like that for a number of interesting reasons. The first of these reasons is that they would assume a “what is… ?” question is a question about something’s essential nature rather than a question about its conventional function or instrumental effect. This assumption reflects a huge difference between Modern and Medieval reality outlooks to start with. To the Medievals, everything has an essential meaning, and accurately discerning true meaning determines right use. To us Moderns, it is the other way around: everything has a use – effective manipulative power, based on a scientific knowledge of how things work, is the criteria of real world truth – and each person can make up whatever meanings and values they like. Indeed, to us, nothing has an essential meaning. To us, use defines value, but value itself has no essential meaning.

Because they were interested in essential meanings the Medievals did not believe in a notion so relativistic and contingent as ‘classical’ supply and demand determined “market value”. Instead, they believed in “true value” where the true (essential) value of anything sold in the market needed to be reasonably reflected in the price if it was to be sold fairly. Here a fair price was seen as a function of properly appreciated real value (knowing what something was really worth). Fair price was a function of the essential value of the traded thing itself and the real value of the skills, labour and pious stewardship of the people who produced and distributed that good. Here also the essential value of the buyer (such as a God-imaged, though poor serf, needing food) must determine the price of, say, bread if that price is to reflect true value. So you would not get an instrumental answer to a “what is?” question of any sort from a Medieval. Further, in relation to the question “what is money?” it would not occur to a Medieval that real wealth, and any means by which wealth is exchanged, would be an arbitrary fiction that had nothing to do with moral and spiritual truths.

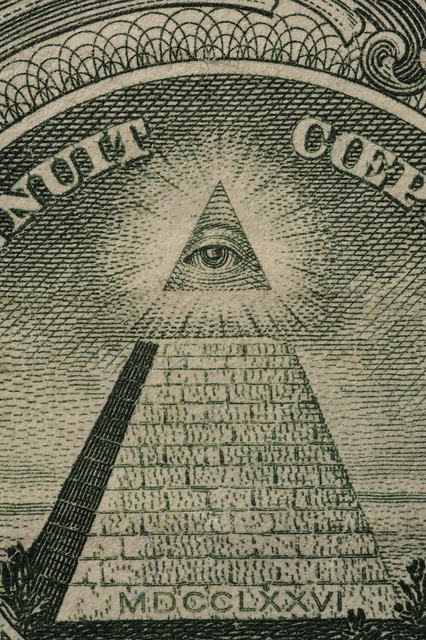

Secondly, unlike today, the Medieval person would not think of money as an abstract numerical cypher, but as a tangible physical thing: a certain amount of a particular metal. (The Medievals, you must remember, lived before the birth of the modern nation state, and thus before central banking which guaranteed the wide spread stability of money as paper based notes of credit. ‘Money’ as we know it today first became widely viable in 1694 when the Bank of England was formed in order to fund a war for King William III.) To the Medievals money was no abstract numerical fiction, money was tangibly metallic. Further, metals were analogues of, even ontologically participants in, cosmic and spiritual realities.

To the Medievals, money was always made out of gold and silver – the metals of the Sun and Moon – and other metals. Gold, for example, as the Sun’s metal participates symbolically (and ontologically) in the Sun. The Sun is the physical source of all life, and thus – so Ficino maintained – an analogy of God Himself, the source and giver of life to creation. The Sun is a tangible icon that points us to the intangible God who is the eternal source and final destiny of all that is. Harking back to Plato’s analogy of the sun, the via antiqua metaphysics of the Middle Ages as well as Renaissance Platonism, saw God is the Goodness beyond Being, out of whom all beings come, the glorious source of the real qualitative value of all that is. Gold as incorruptible, and as the lustrous colour of the Sun, speaks to us of the eternal beauty and splendour of God and iconographically points us to the divine source of all true meaning and value. The wealth and splendour of gold is thus a real, though twice analogically reflected, wealth, and the spiritual reality that gold ‘sacramentally’ points to is divine providence, the source and essence of all wealth which is given to creation by God so that creation might flourish.

Reflecting on the theological meaning of money to a Medieval person, we can see that wealth was understood as a real feature of created reality, and that money was physically (though ‘sacramentally’) bonded to wealth. Thus money was not understood in its essence as an artificial, man-made construct. Unlike today, the Medievals could not envision money as an intangible construct to be used for whatever instrumental pursuit of transaction manipulating power the fertile imaginations of high finance simply dream up. No, to the Medievals money was an active function of real wealth, though wealth in no way reduced to human money.

The reason why I have taken you into the exotic realm of Medieval economics is that it shows us how different metaphysical approaches to money can be, and it makes us aware that our Modern understanding of the nature and meaning of money is not a fixed and certain reality. We can now hopefully see that our astonishingly instrumental and abstract assumed metaphysics of money is one option amongst many possible ways of understanding the nature and meaning of money. Modern money is one way of thinking and acting concerning the relations between work, commerce and finance; it is one way of approaching the nature of finance and its (non) relation to wealth, morality, reality and power. Perhaps, even, the abstract and instrumental nature of our assumed metaphysics of money is deeply implicated in the horrifying pathologies of high finance?

Bearing the above question in mind, let us return to gold.

The catastrophic global financial disaster of the Great Depression was in the vivid memories of those who gathered at Bretton Woods in 1944 to plan and set up the architecture for the post-war global economy. They were determined that the final popping of the massive speculative bubbles of the roaring 20s would not be repeated. How, they pondered, could they fix the value of money to reality so that speculative finance did not become the dog that wagged the tail of the real economy? The answer they came back to was gold. Currencies would be tied in value together, and the American dollar would undergird the new global economy by being tied to gold. $US35 per ounce of gold held money to some real wealth anchor and the fascinating thing is that whilst the gold standard lasted, so did the post-war boom. After the collapse of the gold standard in 1971, speculative finance took off again and the real economy started to take a back seat to high finance again. Come 2008 and the spectre of 1929 can again be seen riding its ghostly horse through the economies of Europe. High finance is now inherently unstable and the dynamic of financial implosion could spread to every corner of the globe at any time.

Perhaps we should think again about the metaphysics of money and the need to tie money in some way to real wealth rather than to let it float disconnectedly from the actual production and provision of human needs. For when that happens monetary bubbles are generated without any contact with real wealth, and money without any real wealth cannot fail – sooner or later – to unravel in bubble bursts that are profoundly destructive of real wealth.

I am not suggesting a return to the gold standard. What I am suggesting is that we must come to terms with the obvious fact that our collective metaphysical assumptions about the nature of money are now failing us badly. For today, money has no contact with real wealth, for it has no contact with reality. As Satyajit Das succinctly puts is “money and the games played [by high finance] are intangible, unreal, and increasingly virtual.” This entirely artificial conception of money has deep pathological tendencies which are profoundly destructive of real wealth.

High finance has a frankly criminal tendency such that it facilitates the transfer of real wealth from the public purse – the coffers of states in which wealth is gathered from the people for the common good of the people – into private hands. Yet our banks have this criminal ability because they are tied to our governments (as, since 1694, the big banking players have always been). Astonishingly, after the Federal Reserve Bank of the US poured trillions of tax payer guaranteed money into the private banking sector in 2008, no-one went to jail for extortion even though this is undoubtedly the largest single act of financial extortion in human history. Because global finance is dominated by institutions that are “too big to fail” this means we tax payers must keep them eating our very flesh, and the flesh of our children, in order that the economy – which apparently operates for our welfare (ha!?) – does not implode. Feed us or else we take you all down! This is extortion pure and simple.

Why do we let our governments and our high finance sectors act in so obviously criminal ways? Perhaps it is because we unquestioningly assume that money is an amoral, abstract, artificial and purely instrumental entity that is just made up. For if money is just a number that is ‘produced’ and manipulated by reserve banks and financial specialists, then we naturally assume a bizarre sort of ‘realism’ where entirely artificial finances are seen as the legitimate repositories of right order and real power. Assuming this sort of financial and political ‘realism’, it seems natural to us that our governments have the authority and legitimacy of an economic priest-caste which acts in consort with our magical banking gurus to keep the world as we know it chugging along in proper cosmic harmony

If we are to change this situation, we need to change the way we think about money, wealth and power. This is where the fundamental matters are that will determine our future.

We are not, of course, going to banish extortion or immoral instrumentalism just by having better metaphysics. Criminals, extortionist and abusers of violent power were as common and powerful in the Middle Ages as they are today. Yet if we do not appreciate the relationship between the prevailing order of wealth and power and the metaphysical assumptions which we all share when we engage in the use of money and the practise of politics, then the vital collective sources of our norms and of how power is sustained will be invisible to us. The main game is, indeed, a struggle for our minds. Plato saw this with characteristic insight. As long as we believe that illusions are reality, we are controlled by those who manipulate the collective illusions that structure the operational norms of the world of finance and power as we currently know it.

How do we get money tied to the realities of real human life so that it becomes a fair function of the actual production and distribution of real wealth? How do we re-introduce the idea that finance should be tied in some concrete way to the real world in which actual producing and consuming people live? How can we get finance to serve human (that is political) ends rather than politics facilitating financial ends for high flyers in investment banking? These are the vital questions for us today in the post-2008 world.

Dr Paul Tyson

Honorary Associate Professor

Theology

University of Nottingham